Classic Car Insurance

Specialist insurance for classic and vintage vehicles from Footman James.

- Classic car insurance brokers for over 40 years

- Policy can be tailored to suit your individual requirements

- UK-based support

One of the UK's leading independent insurance brokers

Why choose classic car insurance with Footman James?

Tailored classic car insurance

Tailor your policy to suit your needs with our range additional cover options

Agreed value

Add agreed value to your policy to peace of mind

Car club member rates

Specialists rates for club members

Pay for your classic car insurance by direct debit

You can split your payments into instalments

About classic car insurance

Our comprehensive classic car insurance policy provides shows and events cover as standard plus European motoring for 35 days too. You can also tailor the policy by choosing from a range of optional extras including agreed value, breakdown cover, legal protection and more.

Rely on our expertise

Classic vehicle insurance specialists for over 40 years. Footman James was acquired by Towergate in December 2013 as a leading specialist in classic motor insurance. Footman James understands the cherished car movement and has developed a wide range of products for owners, collectors and professionals alike.

Agreed value classic car cover

Agreed value is a key feature for classic car owners to consider adding to their policy. Rather than insuring your car at market value, you are able to take into consideration its classic car status and agree a value with us before you insure. If you then suffer a total loss claim, you will receive the full value agreed. Just remember, your policy excess will be deducted from the total.

Retrieve and store your documents online

We're ever improving our service for our customers and online customers are able to retrieve and store their policy documents online. Simply login to our new document portal and find all your documents in one place.

Specialist insurance rates for car club members

We give specialist rates if you are a member of a Footman James approved classic car club. These can be applied both online and over the phone. You can also get discount if you limit the mileage on your cherished car insurance policy. Mileage options available are between 1,000 and 10,000 miles.

When you need to make a claim, we'll guide you through the process and get your claim settled as quickly as possible.

- Find your insurance documents and make sure you have all your information at hand, including your policy number.

- Call the claims team on the number in your policy schedule and explain exactly what happened.

- Provide photos if requested to help us understand what happened as quickly as we can.

Ready to get covered?

- Fill in our online quote form or call us

- Purchase your policy

- Relax - You're covered!

Classic car insurance FAQs

Normally 20 years, however this can reduce for certain marques or subject to certain club membership.

Agreed value means if your vehicle is lost or totally destroyed, and the value of your vehicle has been agreed, you have the certainty that you will be paid out the amount shown on your policy schedule.

You should be aware that the maximum amount payable by insurers will be the amount shown under ‘Value’ on the Vehicle Details section of your Renewal Schedule, regardless of the market value at the time of the loss.

Market value means if your vehicle is lost or totally destroyed, you will be paid out the value of the vehicle at the time of the claim in line with current market trends.

This could be more or less than the amount shown under ‘Value’ as shown on the Vehicle Details section of your Renewal Schedule.

- Obtain the name and address of any persons involved in the accident and any witnesses. This should include details of any passengers in any other vehicle involved.

- Report any claim, accident, theft or loss as soon as possible by contacting the telephone helplines shown in your insurance documents. The sooner we know about an incident the sooner we can start helping you.

- Send any writ, summons or letters received in connection with any claim, accident or loss to us as soon as you receive them.

- Tell us at once if you receive any notice of prosecution, inquest or fatal accident inquiry connected to the incident.

- Report any theft, or your vehicle being taken without your consent immediately to the police and obtain a crime reference number

- You should not admit that the accident was your fault

- You should not attempt to negotiate the settlement of a claim from another person.

We will defend or settle any claim made against you on your behalf

Classic car insurance offers classic car owners specialist protection such as breakdown cover, legal protection, spare parts, salvage retention, and agreed value or market value to ensure you get back what it’s truly worth should something happen.

Protecting your car from being out on the roads and the risks that come with driving is even more important when it comes to a classic car or vintage vehicle. Making sure that you have the right policy to cover your vehicle is hugely important.

There are a number of factors which will impact the level of cover you need and the price you pay.

- Mileage – how far you drive your classic car can impact the price of your insurance and some policies offer a discount if you limit your mileage.

- Value of the vehicle – the amount your car is worth will play a part in determining the level of cover you require.

- Club membership – specialist rates can be offered if you are a member of an approved classic car club.

If you have multiple classic cars it is possible to insure them all under a single policy, which will give you peace of mind whilst also keeping all your details and documents in one place, just speak to one of our advisers about extending your cover to include other classic cars.

There are a range of standard features and additional extras when it comes to classic car insurance, which you can add to create a bespoke policy with cover to suit you:

- Spare parts cover for classic car spare parts and fitted accessories

- Salvage retention in the event of a total loss

- Agreed value, which ensures you get back the true value of the vehicle rather than market value. However, it is important to reassess the agreed value of the vehicle regularly to ensure the figure is up to date. Speak to an insurance adviser for details.

- Breakdown cover options for Europe and the UK

- Legal protection for pursuing uninsured losses can be added

Classic car insurance policies do not usually cover the following:

- Theft of the vehicle, if the keys are in it

- Theft or malicious damage during the night if the vehicle is parked within a mile radius of the home or garage address and is not in a locked garage

- Motorsports or trackside use, unless agreed in advance

- No claims discount

You are also usually not covered if the vehicle is unsafe, unroadworthy, or without a current MOT (if required).

You can take steps to make your classic car insurance affordable whilst still ensuring everything is covered by your policy.

- Classic car club membership – being a member of an approved club can reduce the cost of your premiums

- Invest in secure storage for your car – many classic car insurance policies require the vehicle to be in a garage overnight so ensure that yours is safe and secure

- Decide on the usage of your car – whilst classic car insurance can be flexible to include uses such as race days it is important that the insurer is aware of this so it is important that you make a decision as to what your classic car will be used for.

If you prefer to spread the cost of your annual premium, we offer a quick and easy direct debit scheme. When you choose to pay premiums in instalments, you will be paying under a Premium Finance plan. We will give you full details of the finance provider, and the additional cost of finance, when we provide you with your payment plan quotation. This will include the total payable, the number of monthly instalments and the cost of each, as well as the representative APR.

If you would like to know more about our monthly payment option, please visit our dedicated Direct Debit page.

Thinking of investing in a classic car? When faced with some different options, making the right one can seem daunting.

Investing in classic cars has made something of a resurgence in recent years but with so many options, where does one begin with navigating the tricky waters of finding the right car. The best investments can be categorised in three broad areas: (1) the right brand, (2) limited editions and (3) an illustrious history.

Which car brands are the best investments?

With returns of up to 257% on some classic cars, it is easy to have pound signs in the eyes and just rush into buying the nearest classic car to you. But it is important to realise that this kind of increase won’t apply to every brand of car out there An Austin Maestro isn’t going to rocket to £70,000 in the next five years, for example.

This kind of massive surge in price is usually only reserved for certain brands and the right kind of cars from those manufacturers. You’ll need to head to high-end stuff from the likes of Maserati, Bentley, Aston Martin and Jaguar in order to make a serious profit. For example, a 1974 Jaguar E Type Series 3 V12 Roadster going for £165,000 is almost certain to make a profit on the amount invested.

Limited editions

It’s fairly simple logic that buying cars that had a limited production run will eventually pay off. Take the 1957 Ferrari 250 GT 14-Louver Berlinetta, for example. With just eight examples left on the road (out of nine built) one sold for more than £5.6 million when it was auctioned in August last year. Look out for limited edition versions of cars, too.

Iconic classic cars

Some cars just happen to have a fantastic story attached to them. For instance, the Aston Martin DB5 will forever associated with James Bond and the Mini Cooper S with The Italian Job (and Michael Caine, maybe) – links with film and TV are likely to push the value up even higher. But it’s not just the silver screen that helps. A car used in motorsport is also likely to get a high price at auction - in 2013, the Swiss Grand Prix winning 1954 Mercedes-Benz W196R Formula One racing single seater hit a record breaking £19,601,500. A little history can definitely go a long, long way!

With any investment, there are risks but by looking out for these pointers, you could be on the road to a healthy profit on your investment. Cashing in on the right brand, keeping an eye out on limited editions of popular cars and getting to grips with a potentially illustrious history can help you make the right investment.

Future classic cars

How do you spot that future classic? Some cars may look ordinary to you today, but wait a few years and they could be making you thousands of pounds, if you can bear to let them go.

With classic cars the right models(ranging from iconic or rare cars, to everyday classics like Morris Minors), have been increasing in value for a while now but you do need to be a little wary about what you’re choosing. Consider how much it may cost to maintain, (much like Lego you kind of get the feel you need to keep them in the box) and do your research to see which models will see a return on investment in years to come.

If you’re passionate about classic cars but worried about reliability, it’s worth looking at future classics which may be more dependable and starting to appreciate in value. Though these cars haven't hit iconic status yet, there are several reasons why they might be an ideal investment.

-

They are more affordable now than the current classics because they haven’t yet had that spike in popularity

-

They are usually modern enough that you can still use and maintain them with more easy than older vehicles

-

If you wait long enough and keep an eye on trends, the return on your initial investment stands to be pretty juicy

How to spot a future classic

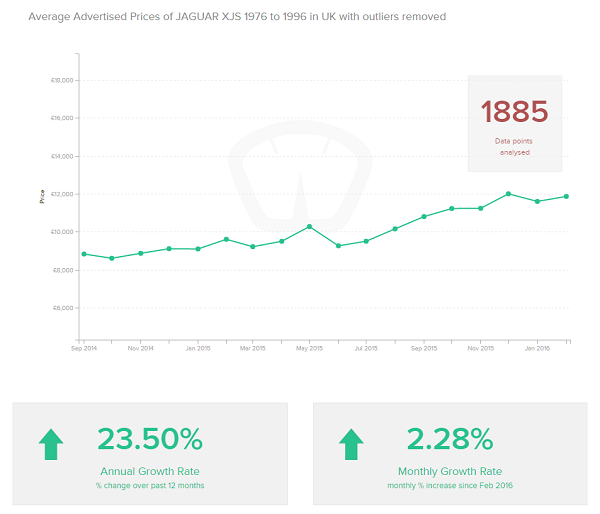

Advertised car prices are a good as a means of determining price trends month on month and year on year. Patina’s Price Trends page, explains the how what and when of how they collect and analyse their data. The team at Patina are more than helpful too; if you don’t think the results seem right, you can speak with one of their panel of experts directly to determine the information you need.

See our range of cover for classic car

Car

Car Excess

Car Insurance for Diplomats

Car Insurance with Points

Celebrity Car

Classic Bike

Competition Car

Disabled Driver

GAP

Learner Driver

Motorcycle Track Day

Non-Standard Private Car

Northern Ireland Car

Over 60s and Over 70s Car

RAC Breakdown Cover

Race Transporter

Track Day Car

Trailer

Van Hire Excess

Vintage Tractor

Young Driver

Classic car insurance articles and guides

18/07/2017

How to find the value of your classic car

Buying, selling or looking to insure a classic car? Discover how with our guide to valuing your classic car using the famous Triumph Spitfire as an example

Read more14/07/2016

Towergate's Top 10 UK Scenic Driving Routes

View our top 10 driving routes across the UK. Written in conjunction with our friends at Footman James.

Read more07/03/2018

Top Tips for Driving on Country Roads

Driving on winding country lanes can be daunting. Our guide contains simple tips for staying safe on country roads.

Read more