Who Is Responsible for Accidental Damage In a Rental Property?

Accidents happen. As a landlord, it’s important to have insurance policies in place that protect both you and your tenants when they do. However, who is responsible for accidental damage in a rental property, what constitutes accidental damage and how do you get your money back?

What qualifies as accidental damage?

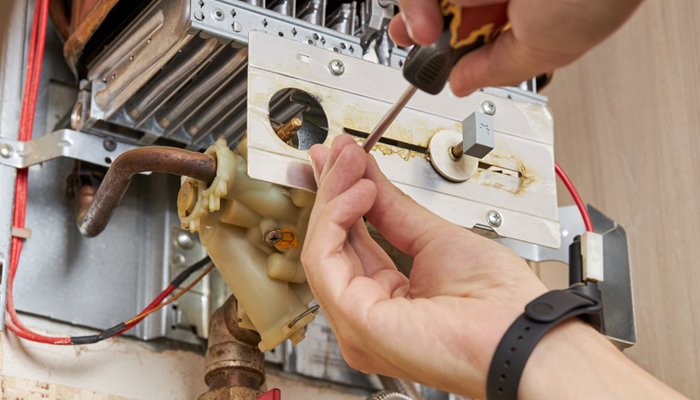

While wear and tear to your property is up to you as a landlord to fix or replace — broken down white goods for example — accidental damage is when something is damaged suddenly and unexpectedly. For example, dropping something and staining a carpet or drilling through wiring or pipes. This is where accidental damage insurance comes into play.

Who is responsible for accidental damage in a rental property?

If the accidental damage is caused by a tenant or their guests, it is their responsibility to pay for it. It is also their responsibility to report the damage to you as the landlord. Then, you can choose to cover the costs or deduct it from your tenant’s deposit.

What is covered by accidental damage insurance for tenants?

It is recommended that tenants get their own contents insurance to ensure their personal items are protected in the case of fire, flood or theft. As a landlord, you should do the same with landlords contents insurance.

Accidental damage insurance may cover the repair or replacement costs for damage that has happened suddenly and without warning. Examples of accidental damage can include:

- Broken indoor and outdoor windows

- Broken locks and keys

- Broken wires, pipes, cables

- Falling through the loft floor

- Damaged toilet, sink, bath, wash basins

Depending on your policy, there may be more or fewer fixtures covered.

What accidental damage insurance does a landlord need?

To cover accidental damage, you should have landlords insurance that includes it in the policy. It may come as standard, but sometimes it’s listed as an additional extra. If you’re confused or can’t find the information you need, talk to your insurance provider and they can help.

How to make sure you get your money back

Before a tenant moves into your property, take an inventory of all your belongings, including things like white goods. Be sure to note the condition of everything, including windows, appliances, toilets and sinks.

This will allow you to determine whether any accidental damage happens during the course of a tenancy. If it does, you can ask your tenant for the cost of repair or go through your insurer.

If you make a successful claim, your provider can help with replacing or repairing the damaged goods. You can also ask your tenant to pay the excess, which will vary in cost from policy to policy.

Be sure to communicate truthfully with your insurer and let your tenant know any updates throughout the process, so they don’t receive an unexpected bill.

What insurance should a landlord have for accidental damage?

It doesn’t matter if you’re a multi-property, student or short-term landlord – when an accident happens, you’ll want to have accidental damage cover in place. Make sure to do this when you arrange your landlords insurance policy. It might not be a legal requirement but it’s there for peace of mind, and for if things go wrong.

Landlord insurance from Towergate

It’s important to have a landlords insurance policy that covers accidental damage to your property, and the fittings and fixtures inside. It can save you from sudden costs and keep your anticipated earnings from your property portfolio where you expect them to be.

Get a Towergate landlord insurance quote

We offer accidental damage as part of our landlord buildings and contents cover policies. You can get a quote either online or by calling our experts on 0330 828 0108.

Commercial property insurance from Towergate

Explore our commercial property insurance options, covering a range of properties from our trusted network of insurers. Whether it's a single property or an entire portfolio, we've got you covered. Get a commercial property insurance quote, call us at 0330 828 0512, or request a call back at a convenient time.

About the author

Alison Wild BCom (Hons), FMAAT, MATT, Taxation Technician is a highly respected industry professional who has been working with and advising SMEs in areas including tax, pensions, insurance and marketing for over 25 years. She is a Fellow member of the Association of Accounting Technicians (AAT), member of the Association of Tax Technicians (ATT) and also has over 20 years' experience as a residential landlord.

Date: August 14, 2024

Category: Landlords