UK Riots 2024

This article is intended to support those that have been affected by the current events. If you have been impacted by the recent events and suffered loss or damage you may find that you have insurance coverage that may be able to help.

Some types of insurance policies may, in certain specified circumstances, provide cover for losses resulting from damage or interruption to their business following riot or civil commotion.

We hope that you have not been affected but in the unlikely event that you have been, here is some helpful information.

What to do if I need to claim

Please report the incident to the police, to obtain a crime reference number. This will be a requirement of your policy.

Please also contact your local Towergate office and provide clear details on any damage that has arisen from the rioting or civil commotion, and the claims team will happily check your policy cover and notify any potential claim to your insurers.

NOTE: your insurers must be informed of a potential claim straight away - many insurers have restrictions in place whereby any claim for damage or interruption must be notified within a short period. In some cases, this may be restricted to SEVEN DAYS from the date of incident.

Please note that not all policies cover riot or civil commotion. Where there is no cover in place, you or the business may be able to seek compensation from the relevant police authority.

In London this is the Lord Mayor’s Office for Policing and Crime and the Common Council for the City of London police area, for any other area of the UK please refer to your local police force website which will have the relevant contact details

Under the Riot Compensation Act 2016 (the “Act”) uninsured businesses and individuals can apply to claim for compensation from the local police authority and can do so by following the claim process in this document.

Remember:

- the amount of compensation is limited to the actual loss due to damage, destruction or theft directly caused during the riot, and cannot usually include any consequential losses.

- the Act sets a £1million compensation cap on each claim.

- the Act allows for claims in relation to motor vehicles which are not insured for riot damage but are covered by an insurance policy.

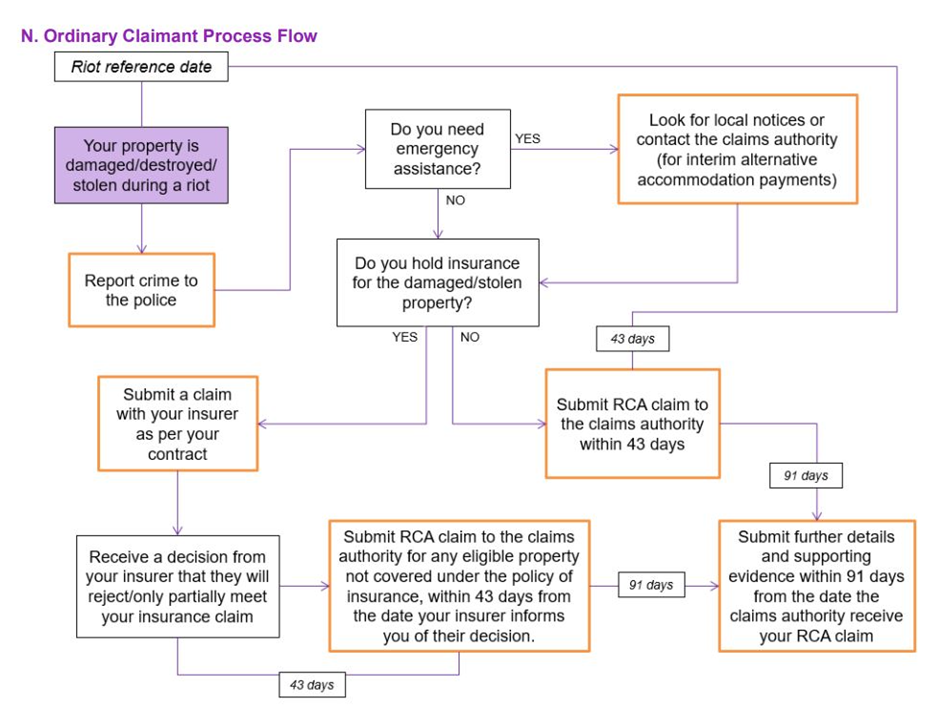

To help you we have provided a process flow chart which has been provided by the Riot Compensation guidance….

Source; riot compensation guidance (publishing.service.gov.uk)

Support for property owners

A property owner, tenant, occupier whether that be for buildings structure or contents can instigate a claim for riot damage/loss. This includes stock a business may hold on the business premises.

Please note that for insurers to consider a claim under the riot clause in an insurance policy (and to qualify for the compensation outlined above) it must be demonstrated that the damage or loss was a direct result of a riot as is defined under section 1 of the Public Order Act 1986 which states:

Riot:

- Where 12 or more persons who are present together use or threaten unlawful violence for a common purpose and the conduct of them (taken together) is such as would cause a person of reasonable firmness present at the scene to fear for his personal safety, each of the persons using unlawful violence for the common purpose is guilty of riot.

- It is immaterial whether or not the 12 or more use or threaten unlawful violence simultaneously.

- The common purpose may be inferred from conduct.

- No person of reasonable firmness need actually be, or be likely to be, present at the scene.

- Riot may be committed in private as well as in public places.

- A person guilty of riot is liable on conviction on indictment to imprisonment for a term not exceeding ten years or a fine or both.

Business interruption due to business closure as a result of a riot or civil commotion

Not all business interruption cover will provide assistance where there hasn’t been government or local authority intervention.

There hasn’t been any government or local authority intervention at this time, although this could change in the coming hours/days. Do ensure that you check the relevant websites for guidance i.e. Gov.UK websites.

We are proactively engaging with insurers around this situation and await any advice from them in the coming days.

We must point out that any claim you do make will of course be subject to the terms and conditions of your policy. We should also stress that not all policies will provide cover.

For more information and guidance please refer to the Association of British Insurers website.

Please feel free to contact your usual Towergate Account Executive should you have any immediate concerns or wish to discuss your individual circumstances.

Please note that the commentary in this article is given as at August 2024 on a non-specific basis and is not legal advice and cannot be relied on as such. We do not assume any legal responsibility for the accuracy of any particular statement and we would recommend that professional advice is sought if you require legal advice.

Date: August 08, 2024

Category: Home and Property