How long do I need to save to buy a house?

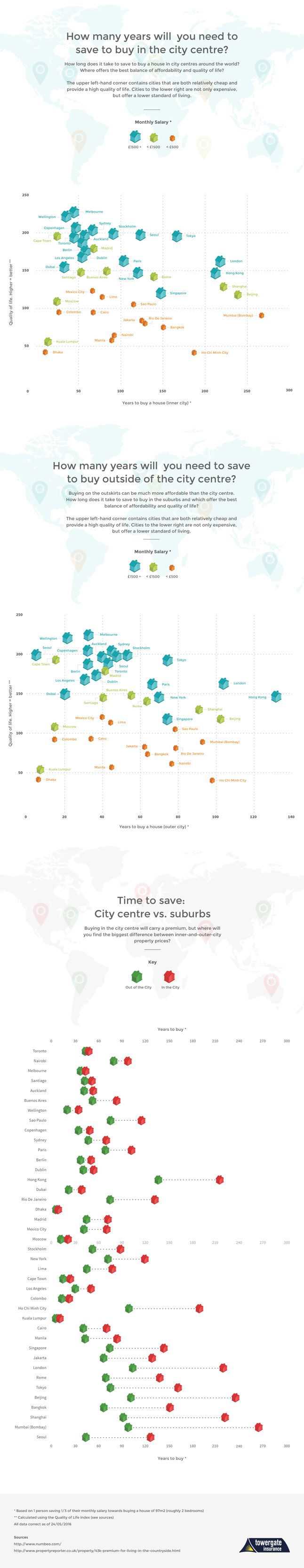

Have you ever thought about which cities around the world are the best to buy property in, compared to average salaries and quality of life? Well, we've put together three infographics plotting cost to buy against quality of life, in and out of cities around the world, which shows just that.

When it comes to buying a property, which cities are the most salary and quality of life friendly? You might be surprised to know that the Southern hemisphere seems to dominate, with three out of the top five cities being from south of the equator. Landlords and first-time buyers alike maybe not be surprised however to know that, on average, it could take up to 113 more years to save to buy a property outright in London's city centre compared with buying on the outskirts? Keep reading to find out exactly how each city stacks up, or scroll down to browse the full results yourself. Click on the infographic to view it in full size.

Key Facts as Illustrated by the Infographics

-

The southern hemisphere dominates when it comes to buying in the city centre, with three out of the top five cities coming from this region, including Melbourne, Wellington, Copenhagen, Toronto and Cape Town.

-

The bottom five cities include Mumbai (Bombay), Ho Chi Minh City, Bangkok, Beijing and Rio De Janeiro.

-

To buy outside of the city centre, the top five cities remain the same except for Berlin taking Toronto's place.

-

The five cities you will have to save the longest time to buy in the city centre include Mumbai (Bombay), Beijing, Shanghai, Hong Kong and London.

-

The five cities you will have to save the shortest time to buy in the city centre include Dhaka, Kuala Lumpur, Colombo, Moscow and Cape Town.

-

The shortest time difference between buying in and out of the city centre include Toronto, Nairobi, Melbourne, Santiago and Auckland.

-

The longest time difference between buying in and out of the city centre include Mumbai (Bombay), Seoul, Shanghai, Bangkok and Beijing.

(click or press for larger image):

About the author

James Cooper is a respected industry leader with around 10 years' experience in the home and property insurance sector. He works across a broad range of insurance product and policy development and delivery, including product development; customer sales and marketing; and P&L accountability.

Date: May 27, 2015

Category: Home and Property